Real estate bubble

The speculative bubble to take into account if you want to sell or buy property.

Let us first introduce a simple and clear definition of the term property bubble.

A real estate bubble is nothing more than an often cyclical phenomenon characterised by a rapid increase in prices to an unsustainable level relative to average income or other economic parameters.

In a balanced market, the price of a given asset is determined by supply and demand.

However, if the supply is insufficient to satisfy a constantly increasing demand, an imbalance occurs.

Put simply, the asset becomes scarcer and the demand proportionally higher, which leads to a price increase. As a result, the price of real estate no longer corresponds to its value, creating a ‘bubble’ in the sector in question and thus a gap between the real value of the property and the price at which it is offered on the market.

Market analysis of the UBS Swiss Real Estate Bubble Index

UBS Swiss Real Estate Bubble Index articles on real estate market price developments and the risk of property bubbles:

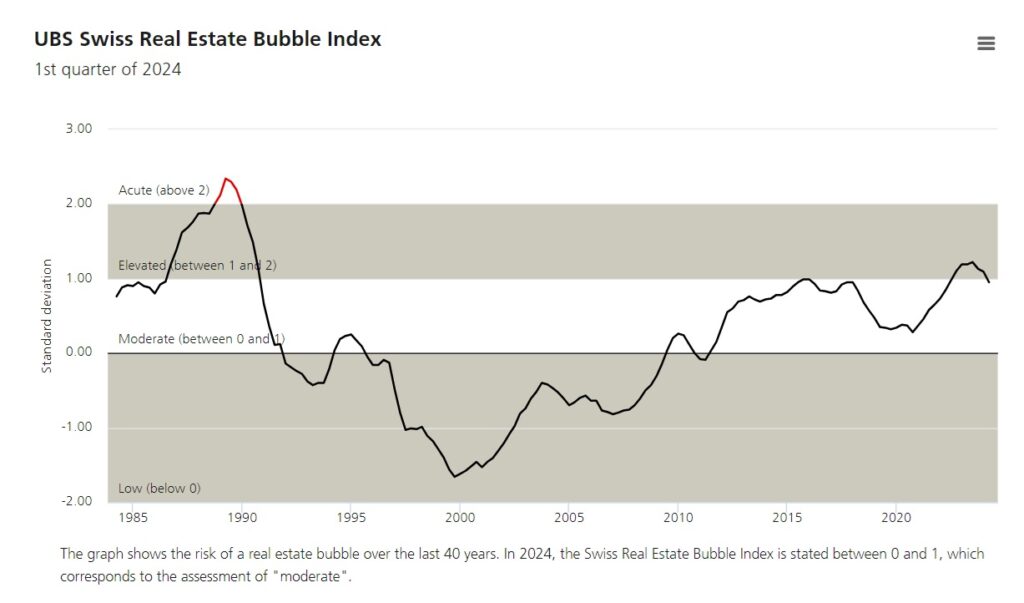

“The UBS Swiss Real Estate Bubble Index continued its decline in the first quarter of 2024 and now stands at 0.95 index points. The risk of a property bubble has thus fallen from “elevated” to “moderate.”

This means the benchmark is significantly lower than during the real estate bubble in the early 1990s.

However, the analysis shows that bubble risk remains high from the perspective of fundamental factors rents and income.

However, the risk of overheating has decreased as a result of weaker price momentum. Falling interest rates and the only moderate level of relative usage costs speak against a price correction.

Overall low and further declining borrowing and new construction also clearly speak against a price bubble.”

How the real estate bubble is calculated by UBS economists

The UBS Swiss Real Estate Bubble Index shows the risk of a possible property bubble in the Swiss market.

To calculate the Bubble Index, UBS economists use a model with several factors: price-to-rent and price-to-income ratios (fundamentals), 3- and 10-year real price change rates (dynamics), purchase-to-rent comparisons (costs) and mortgage-to-income volume and net additions to the portfolio (context).

Based on present value, real estate bubble risk is divided into the following four categories: Acute (above 2), High (between 1 and 2), Moderate (between 0 and 1) and Low (below 0).

For further updates, UBS Banck constantly monitors real estate market trends, information on the latter can be found on their website.

Although the market is experiencing some tension, we can reassure you that the slowdown in interest rates and continued demand are calming the waters of a real estate storm. This is a very good point for those who want to sell or buy their home.

Your anfina team

anfina immo ag

Flobotstrasse 3

8044 Zürich

Schweiz

Phone +41 43 541 23 60

[email protected]

http://www.anfina.ch

UID: CHE-196.432.915 MWST

Realisation

Casasoft AG

Thurgauerstrasse 36

8050 Zürich

www.casasoft.ch